So fast forward to post recession economics where once great companies have sullied reputations, auto makers are booming again, and interest rates are still non-existent. Dividend income is where it's at and the once great dividend powerhouses that helped millions work towards financial freedom were crushed. There are times during investing that you have to take a chance and make some smart, educated gambles. So on March 13, 2014 I took a close look at American International Group (AIG) and liked what I saw. To understand why this was a gamble one need only to look at the recent history of this once enviable organization.

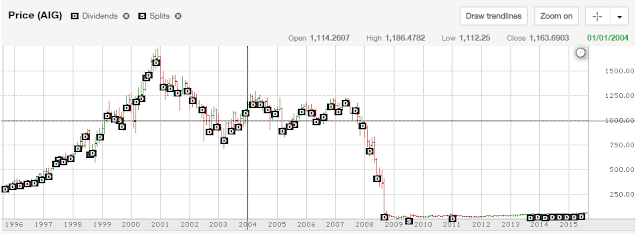

American International Group is one of the largest insurers in the world and when the financial crisis hit it was one of the first "too big to fail moves" The federal reserve stepped in and bailed out AIG to the tune of $85 billion and this is when AIG suspended their dividends. To get a better understanding here is a quick breakdown of the events around AIG circling into it's demise:

- A – 9/15/2008 Collapse of Lehman Brothers: This is widely regarded as the event that set the financial crisis in motion.

- B – 9/19/2008 AIG Pays a Dividend: This would be the last dividend AIG would pay for five years.

- C – 9/23/2008 AIG Officially Suspends Dividend: The government bailout forced the company to suspend its dividend.

- D – 8/1/2013 AIG Officially Reinstates Dividend: After strong earnings, the company announced that it would bring back its dividend distribution.

- E – 9/26/2013 AIG Pays a Dividend: In its first dividend in 5 years, AIG paid out $0.10 per share to its shareholders.

To really understand how much this company fell off a cliff let's look at what the value of the stock was and paying a hefty $4.40 dividend!

This chart is really telling, AIG was CRUSHED during the financial crisis and prior to it it was a high flying company. So how has AIG looked the last three years?

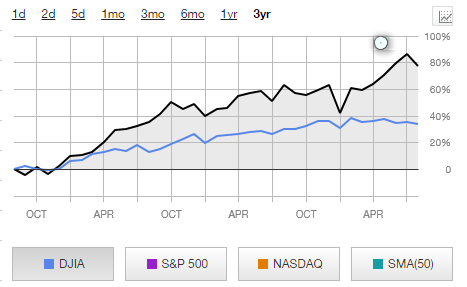

As you can see it has handily outperformed the DOW and is up almost 80% in that time period. Since I have bought the dividend has been at $0.125 per share, a far cry from that $4.40 mark only a few short years ago. Yesterday AIG made a huge dividend announcement coupled with a new $5 billion share buyback program.

The big news for me is that the dividend increased a whopping 124%, that's a huge increase and a big vote of confidence for the company's future in my opinion. This increase adds $125.39 a year in dividend income. This is fantastic and proof that ever once in a while taking a calculated risk is worth the chance.

Tell me about your best calculated risk and why you did it.

My most calculated risk was going all in on Real estate in 2008 - 2012. It has provided me a solid 6-figure passive income stream.

ReplyDeleteAbsolutely perfect timing, it's one of those I wish I knew type moments. But I was in my late 20s when the wheels fell off. Didn't understand, nor have the capital, to really invest like I am now. Fantastic timing for you!

ReplyDeleteWhoa - 124% increase in the dividend?! That must have been quite a rush when you saw that announcement!

ReplyDeleteIt can be damn near impossible to predict a massive dividend increase like this but picking up companies that have a proven history of dividend increases usually pays out well in the long run. Companies that maintain and/or increase their dividends also prove their ability to generate cashflow through operations - which is key.

I haven't been involved in the investing game too long to know whether any of my calculated risks are paying off, but hopefully I'll see the benefits over the long run!

Cheers